Paying more to provide extra benefits

Paying more to provide extra benefits

There are several ways you can pay extra to provide even greater retirement benefits such as either by paying AVC’s or APCs.

Building up extra savings

A guide to additional voluntary contributions (AVCs) in the Local Government Pension Scheme (LGPS)

AVCs – a summary

- Build up extra savings for retirement with an AVC

- Flexible contributions – you can choose how much you pay

- Your contributions get tax relief

- You can choose what funds to invest in, some with higher risks/greater potential rewards than others

Use your AVC to get:

- Up to 100% tax-free cash lump sum*

- Additional LGPS income

- Guaranteed regular income for life (an annuity)

- Both lump sum and income

* Conditions apply

What are AVCs?

AVCs allow you to pay more to build up extra savings for your retirement.

When you save AVCs, you pay money into a separate AVC plan in addition to the main Local Government Pension Scheme (LGPS). You build up a pot of money that you use to provide additional benefits to your main LGPS benefits.

Your AVC plan becomes payable when you take your main LGPS benefits.

All local government pension funds have an arrangement with an AVC provider (often an insurance company or building society) in which you can invest money in funds managed by the AVC provider.

These arrangements are known as inhouse AVCs and are referred to as AVCs in this guide.

AVC contributions are taken directly from your pay before your tax is worked out, so, if you pay tax, you receive tax relief automatically.

The amount of tax relief you receive depends on whether you are a basic, higher or additional rate taxpayer. If you don’t pay tax, you won’t benefit from tax relief.

You have your own personal account that, over time, builds up with the contributions you pay in. The amount in your account depends on how long you pay AVCs for, the impact of charges and how well the fund(s) you invest in perform. You choose how the money in your AVC plan is invested.

Your AVC plan is an investment and the value can go down as well as up. You may not get back what you put in.

You can pay up to 100% of your pensionable pay (subject to other deductions made by your employer) into an AVC. You may wish to get independent financial advice about taking out an AVC.

If you are interested in paying AVCs, you should contact your pension fund for further information.

How do AVCs work?

How much can I pay in?

You can pay up to 100% of your pensionable pay (subject to other deductions made by your employer) into an AVC.

Flexible Contributions

You can choose to pay a fixed amount or a percentage of your pay, or both, into an AVC – as long as it does not exceed 100% of your pay.

AVCs are taken from your pay, just like your normal pension contributions. Deductions start from the next available pay period after you’ve set up the AVC. You may vary your contributions or stop payment at any time while you are paying into the LGPS.

You can pay AVCs if you are in the Main or 50/50 section of the LGPS.

AVCs and extra life cover

You can also pay AVCs to provide extra life cover. Your membership of the LGPS already gives you cover of three times your assumed pensionable pay if you die in service. You can pay AVCs to increase this and provide additional benefits for your dependants if you die in service. Any extra cover you buy will stop when you take your LGPS benefits or leave.

Get tax relief

Your LGPS and AVC contributions are deducted before your tax is worked out, so, if you pay tax, you receive tax relief automatically through the payroll.

Although most people will be able to save as much as they wish into an AVC, the amount of pension tax relief you can receive is limited. See the ‘Tax controls and your pension’ section at the end of this guide for more information.

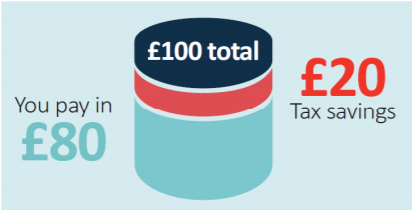

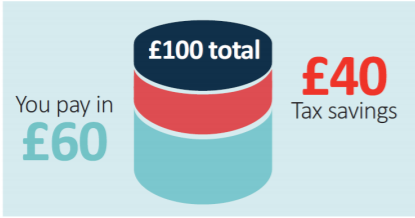

How the tax relief works:

AVC contributions are taken from your pay before tax. Any money you would normally pay as income tax automatically goes into your AVC pot instead. If you pay tax at a higher rate, our tax savings will be higher. If you don't pay tax, you won't benefit from tax savings.

For a basic rate taxpayer - a £100

investment in your plan costs you £80

For a higher rate taxpayer – a £100

investment in your plan costs you £60

How you save with an AVC

The AVC provider will set up your own personal account. Your account builds up over time with your contributions and any investment returns you make. The amount in your account will depend on how long you pay AVCs for, the impact of charges and how well the fund(s) you invest in perform.

You choose how the money in your AVC plan is invested. The investments on offer will have varying risk levels – the higher the risk, the higher the potential rewards. The lower the potential rewards, the lower the risk. You may be able to spread your investments (and risks) over a number of investment areas such as equities (shares), bonds, property and cash. Each have their own risk/potential rewards.

As with all investments, the value may go up or down and you may not get back what you put in.

What can I do with my AVC?

This section outlines how you can use your AVC plan in the LGPS and the option of transferring your AVC plan to a different pension arrangement.

When you take your main LGPS benefits, you can use your AVC to:

1) Buy a regular income that is guaranteed to be paid for the rest of your life

You can use your AVC plan to buy a lifelong, regular income (also known as an annuity) that is guaranteed to be paid for as long as you live. Annuities offer different features that may be of interest to you, such as improved terms if you are in poor health and annual increases to keep up with the cost of living.

When you buy an annuity, you can usually take some of your AVC plan as a tax-free lump sum at the same time and use some or all of the balance to buy an annuity. An annuity is paid completely separately from your LGPS benefits.

The amount of annuity depends on several factors, such as interest rates and your age. As a rule of thumb, the older you are when you take out an annuity, the higher the income you’ll get.

You also have some choice over the type of annuity. For example, whether you want a level annuity that provides a higher income to start with, but the payments will

stay the same for life, or an escalating annuity that will start at a lower rate but will increase over time to keep up with the cost of living. You can also choose whether you

want to provide for dependants’ benefits in the event of your death.

You don’t have to buy an annuity from your AVC provider – it’s really important that you shop around to get the best ‘annuity rate’ based on your personal circumstances and the annuity features you’re looking for.

You would normally buy an annuity at the same time as you take your main LGPS benefits. However, if you left the LGPS before 1 April 2014, you can leave your AVC plan invested and use it later.

2) Buy a top-up LGPS pension

If you paid into the LGPS on or after 1 April 2014, you can use some or all of your AVC plan to buy extra pension from the LGPS. The extra pension you buy will increase in line with the cost of living.

If you take this option, your dependants will automatically be provided with extra pension in the event of your death.

3) Take some or all of your AVC as a single tax-free lump sum

You can take some or all of your AVC plan as a tax-free lump sum, provided that:

- When added to any lump sum you take from your main LGPS benefits, the total tax-free lump sum does not exceed 25% of the overall value of the LGPS benefits you are taking at that particular time, including the value of your AVC plan.

- Your maximum tax-free lump sum does not exceed 25% of the lifetime allowance (£263,750 for the tax year 2019/20) or 25% of your remaining lifetime allowance, if you have previously taken payment of any benefits.

4) Buy extra membership in the LGPS

This only applies if you started paying into your AVC plan before 13 November 2001.

If this was the case, you may be able in certain circumstances (such as flexible retirement, retirement on Ill-health grounds, or on stopping payment of your AVCs before retirement) to convert your AVC plan into extra LGPS membership in order to increase your LGPS benefits.

The extra membership will attract a pension of 1/60th of your final pay for each year of membership purchased.

5) Leave your AVCs invested and use them later but only if you left the LGPS before 1 April 2014.

If you left the LGPS before 1 April 2014, you can choose not to take your AVC plan when you take your main LGPS benefits. You can leave your AVC plan invested and use it at a later date; however, you must take it by the age of 75.

If you do not take your AVC plan at the same time as your main LGPS benefits, you will be restricted to taking a maximum of 25% of your AVC plan as tax-free cash and buying an annuity with the remainder when you do take it.

If you paid into the LGPS on or after 1 April 2014, you must take your AVC plan at the same time as you take your main LGPS benefits.

6) You may be able to transfer your AVC fund to another pension scheme or arrangement

You can transfer your AVC plan to one or more different pension arrangements even if you are still an active member of the main LGPS scheme. However, you must stop paying AVCs in any LGPS employment you hold before you can transfer your AVC plan. If you hold more than one AVC plan, you must transfer all of your plans (even if they are held with different LGPS funds).

Different pension providers offer different options for how you can use your AVC, including the option to buy regular income (an annuity). By transferring out to one or more different pension arrangements, you may be able access options that are not available under the LGPS rules, such as:

- take a number of lump sums at different stages. Usually, the first 25% of each cash withdrawal from your pot will be tax-free with the rest subject to tax.

- take the entire pot as cash in one go. Usually, the first 25% will be tax-free with the rest subject to tax. Remember, it is possible to take your entire LGPS AVC plan as a tax-free lump sum, subject to certain conditions, if you leave it in the LGPS and take it at the same time as your main LGPS benefits.

- provide a flexible retirement income. This is known as flexi-access drawdown. You are normally allowed to take a tax-free lump sum of up to 25% then set aside the rest to provide taxable lump sums as and when, or a regular taxable income.

There may be tax implications associated with accessing your benefits in the ways described above. The income from a pension is taxable; the rate of tax you pay depends on the amount of income that you receive from pensions and from other sources.

The different options mentioned above have different features, different rates of payment, different charges and different tax implications.

Some warnings and things to think about

As with all financial decisions, you should think about your own personal circumstances. You should also consider that money from a pension counts towards any income tax that you might have to pay. Transferring your benefits from the LGPS could adversely affect yours and any dependant’s eventual retirement income. If you are thinking of transferring your AVC plan, you should be aware that scammers operate in these markets and are after your pension. You can read more about how to

protect yourself from scammers at: www.thepensionsregulator.gov.uk/individuals.